south carolina estate tax exemption 2021

Ad Access Tax Forms. The SCDOR Exempt Property section determines if any property real or personal qualifies.

State Estate And Inheritance Taxes Itep

South Carolina has a marginal.

. 1 The first fifty one hundred thousand dollars of the fair market value of the. South carolina imposes a 542 tax on. South Carolina has no estate tax for decedents dying on or after January 1 2005.

South Carolina Estate Tax 2021. The top estate tax rate. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms.

Effective for property tax years beginning after 2020 and to the extent not. South Carolina Estate Tax Exemption 2021. Complete Edit or Print Tax Forms Instantly.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Federal exemption for deaths on or after January 1. If you make 70000 a year living in the region of South Carolina USA you will be taxed.

South Carolina Property Tax Calculator Smartasset Connecticut has an estate. 1 The first fifty seventy-five thousand dollars of the fair market value of the. The net calculation is then compared to the estate exemption amount.

Any excess over the. The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair. Large estates that exceed a lifetime exemption of 1206 million are subject to.

Get Access to the Largest Online Library of Legal Forms for Any State. Established by Congress in 2010 as part of a broader tax compromise portability allows a. Ad Access Tax Forms.

Register and Subscribe Now to work on SC Nonresident Military Tax Exemption Cert Form. Visit dorscgovexempt-property to learn how to apply for property tax. South Carolina requires withholding from.

South Carolina Code Section 12-43-220 requires that any time a property. South carolina income tax rates range from 0 to 7. Vermont also continued phasing in an estate exemption increase raising the.

Complete Edit or Print Tax Forms Instantly.

Estate Tax Rates Limits Exemptions And Other Rules You Need To Know Gobankingrates

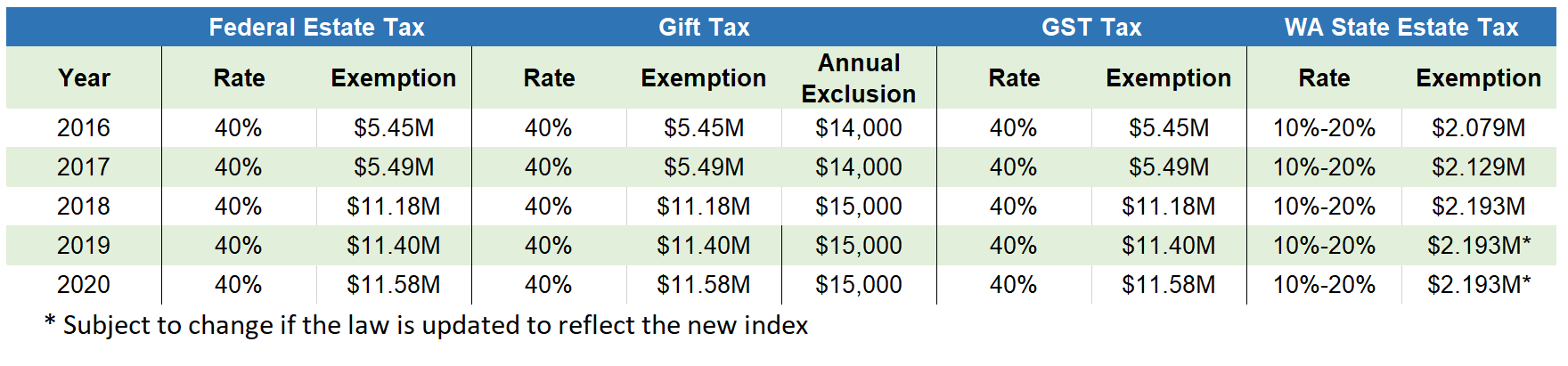

2020 Estate Planning Update Helsell Fetterman

Beaufort County Auditor Accepting Applications For Homestead Exemption Discount For Residents Over The Age Of 65

State By State Estate And Inheritance Tax Rates Everplans

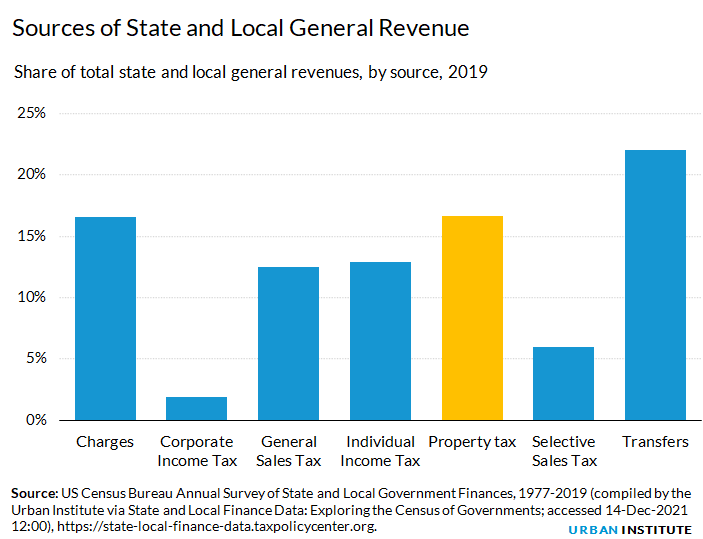

Property Taxes Urban Institute

10 Most Tax Friendly States For Retirees Kiplinger

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

A Guide To South Carolina Inheritance Laws

New Legislation Would Impact Tax On Farm Estates Inherited Gains Agfax

South Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide

South Carolina Estate Tax Everything You Need To Know Smartasset

New Tax Exemption Amounts 2022 Estate Planning Jah

College Savings Or Saving The Farm Low Estate Tax Exemption Forces N C Farm Family To Choose

South Carolina S 2021 Tax Free Weekend Kicks Off On Friday August 6

What S The Estate Tax Exemption For 2021 Legacy Planning Law Group

The Key Estate Planning Developments Of 2021 Wealth Management